Hours: Mon-Thur 7am-8pm, Fri 7am-7pm, Sat 9am-2pm CT

Find the Right Medicare Advantage Plan For You

Are you or your loved one aging into Medicare, recently moved, or lost coverage? If so, learn more about Medicare Advantage plans by speaking to a licensed insurance agent.

Click to call

The Medicare Advantage Plan Guide For Beneficiaries & Their Loved Ones

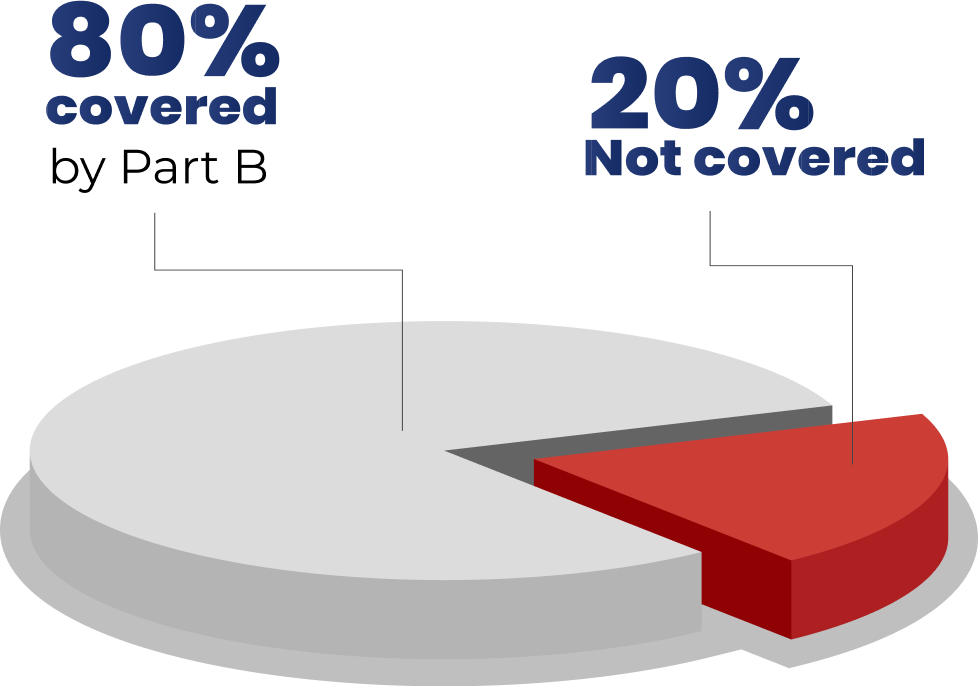

Did you know that Part B of Original Medicare only covers 80% of most healthcare costs? This leaves the remaining 20% for you or your loved one to pay out of pocket.1

While navigating Medicare Advantage plans can be complex, knowing how you’re going to afford care shouldn’t have to be.

Medicare Advantage plans are a common alternative to Original Medicare, as they’re required to cover everything that Original Medicare covers but may include one or more of the following benefits:

Routine vision

Routine dental

Routine hearing

Prescription drug coverage

Work with a licensed insurance agent to see what Medicare Advantage plans with additional benefits may be available in your area.

We represent MA, MAPD, and PDP Plans For [Aetna], [Anthem], [Cigna Healthcare], [Devoted], [Humana], [Kaiser Permanente], [WellCare], and [UnitedHealthcare®].

Medicare Advantage Plans | Original Medicare | |

|---|---|---|

Cost Savings | Medicare Advantage plans have an out-of-pocket maximum and lower copayments may be available, which can lead to potential cost savings. | Original Medicare has no out-of-pocket maximum, meaning there is no limit to the amount you can expect to pay throughout the year on healthcare costs. |

Additional Benefits | Medicare Advantage plans may include additional routine benefits such as dental, vision, hearing, and/or prescription drug coverage. | Original Medicare does not include routine dental, vision, and hearing care. |

Plan Options | The average Medicare beneficiary has access to 43 Medicare Advantage plans2, so you can pick which plan from the insurance carriers we partner with that meets your needs or the needs of your loved one. | Original Medicare is a one-size-fits-all healthcare model, meaning what’s available to you or your loved one is the same as what’s available to another beneficiary enrolled in Original Medicare. Nothing more, nothing less. |

Medicare Advantage Plans

Original Medicare

Cost Savings

Medicare Advantage plans have an out-of-pocket maximum and lower copayments may be available, which can lead to potential cost savings.

Original Medicare has no out-of-pocket maximum, meaning there is no limit to the amount you can expect to pay throughout the year on healthcare costs.

Additional Benefits

Medicare Advantage plans may include additional routine benefits such as dental, vision, hearing, and/or prescription drug coverage.

Original Medicare does not include routine dental, vision, and hearing care.

Plan Options

The average Medicare beneficiary has access to 43 Medicare Advantage plans2, so you can pick which plan from the insurance carriers we partner with that meets your needs or the needs of your loved one.

Original Medicare is a one-size-fits-all healthcare model, meaning what’s available to you or your loved one is the same as what’s available to another beneficiary enrolled in Original Medicare. Nothing more, nothing less.

Your Medicare Advantage Plan Checklist

As you or your loved one prepares to speak with a licensed insurance agent about Medicare Advantage plans, keep the following in mind to help your agent understand your current coverage, priorities, and health.

To help your licensed insurance agent compare the available Medicare Advantage plan options to your current coverage accurately, it may be helpful to have the following information on hand:

Carrier Name/Plan Name

Current Monthly Premium

Annual Deductible

Type of Plan (HMO, PPO)

One of the most important considerations when choosing a plan is whether or not you or your loved one will be able to see preferred doctors and specialists. Make sure you have a list of your doctors’ information handy (such as name, type of doctor, phone number, and number of visits in the last 12 months).

Just like your doctors, it’s important to ensure your or your loved one’s prescription medications are covered by your Medicare Advantage plan. Please be sure to have a list of the medications, doses, quantities, and cost per refill ready.

To help you or your loved one find an available Medicare Advantage plan, we’ll want to know what’s most important to you. Consider the following ahead of your call with a licensed insurance agent:

Cost of co-pays/co-insurance

Cost of annual deductible

Cost of monthly premiums

Cost of prescription medications

Additional coverages

Coverage for specialized medications

Coverage for specialist visits

Coverage while you’re away from home/traveling

Be sure to have your or your loved one’s current insurance information and/or Medicare ID card (red, white, and blue card) for the call.

Do You Qualify for a Special Enrollment Period? See if You’re Eligible for a Medicare Advantage Plan Review

While your call with one of our licensed insurance agents will cover a lot of ground, we’re here to guide you through the process and answer any questions you have along the way.

{dynamicPhone} (TTY: 1-877-486-2048) to talk with a licensed insurance agent or simply provide your zip code below.

If you are helping a loved one, your loved one must be present on the call with a licensed insurance agent or you must have Power of Attorney privileges.